+91 9212007566

011-41620109 / 011-26100109

Provision of Advance Ruling Section 245N (a)

Provision of Advance Ruling Section 245N (a)

Advance Ruling is the decision in advance by Authority empowered to pass it. Advance ruling is Written Decision by the authority regards to the tax consequences of a future financial transaction. Purpose of Advance ruling is render a clarification on the issue on which two views are possible, so that assessee proposing to execute the transaction (for which advance ruling is sought), have a clear mind about tax liability in advance for a given set of transaction’s.

Who can sought Advance Ruling?

Non-Resident

Resident Undertaking transaction with non-resident and the advance ruling sought for question of law or fact in regarding the tax liability of the non-resident Assessee.

Resident Assessee undertake or propose to undertake a financial transaction involving amount of Rs. 100 crore or more.

Notified Public Sector Company.

Procedure for obtaining Advance Ruling

Applicant who wish to undertake transaction or already took the transaction shall apply to the authority in a prescribed form for this purpose mentioning the question or questions for which advance ruling is sought. Application should be submitted in 4 copies.

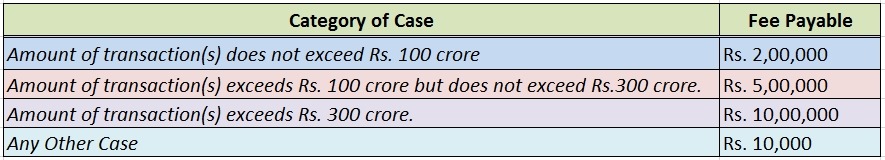

Fees Payable for Advance Ruling is as Follows:

Our Services

EXTERNAL LINKS

ABOUT US

- 011-41620109 / 011-26100109

+91 9212007566

Disclaimer:

The information provided under this website is solely available at your request for informational purposes only, should not be interpreted as soliciting or advisement. We are not liable for any consequence of any action taken by the user relying on material/information provided under this website. In cases where the user has any legal issues, he/she in all cases must seek independent legal advice

The information provided under this website is solely available at your request for informational purposes only, should not be interpreted as soliciting or advisement. We are not liable for any consequence of any action taken by the user relying on material/information provided under this website. In cases where the user has any legal issues, he/she in all cases must seek independent legal advice