+91 9212007566 / 9310221602

011-41620109 / 011 49950109

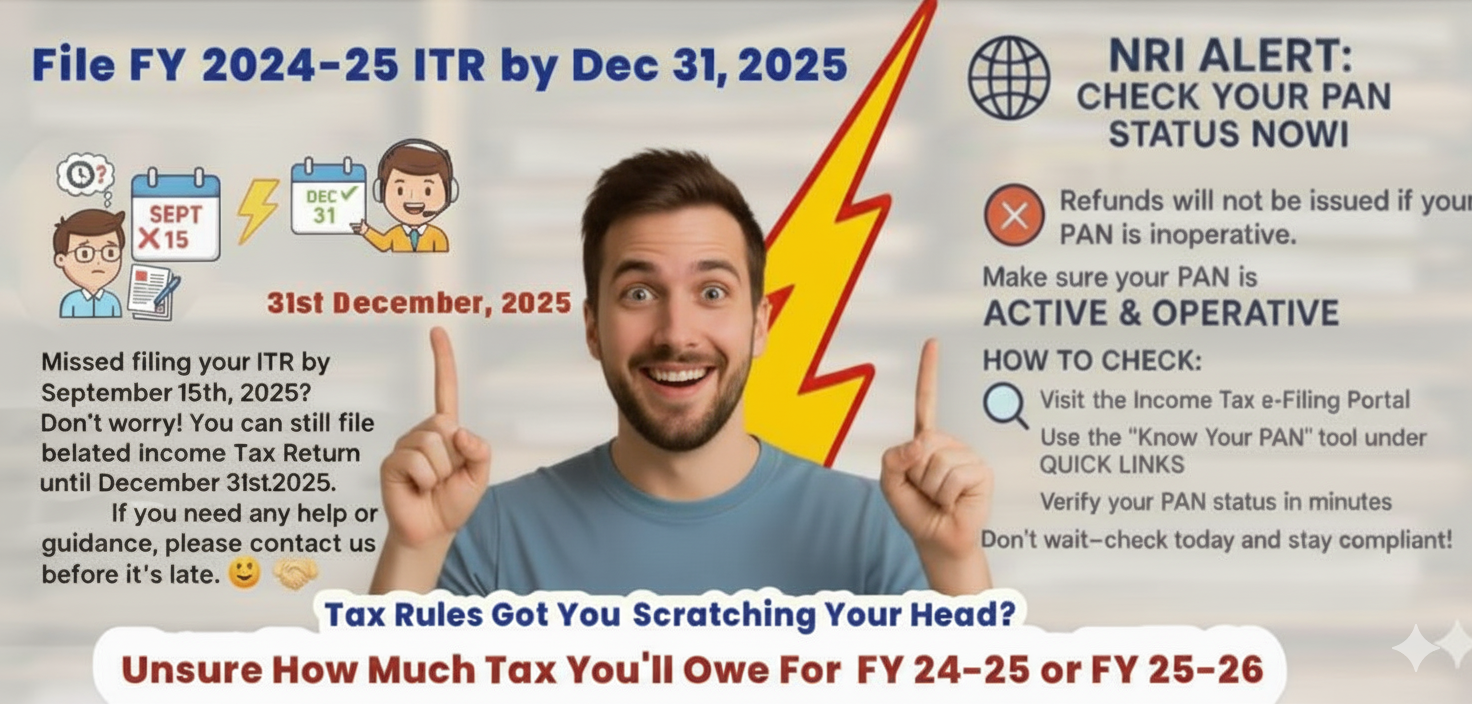

First Slider Image for Atul Mangal & Co

backgroundNew-04

Banner-02 (1)

Banner-New-01

Second Slider Image for Atul Mangal & Co

Third Slider Image for Atul Mangal & Co

Fourth Slider Image for Atul Mangal & Co

Quick Glances

- In case you are not the primary account holder in a joint account in any bank then while filling your income tax return avoid providing such account details as your refund from income tax department may not come in that account. So provide only the other bank account details to get your refunds timely.

- Refund from Income tax departments are getting blocked if the Name, Date of birth, and other Know your customer (KYC) particulars are not same in PAN Card, Aadhar Card and in Bank account. All needs to be same for getting refund from income tax department

About Our Firm

“Atul Mangal & Co.”, the best CA firm located in South Delhi is founded by CA ATUL MANGAL. It is a leading Indian Chartered Accountants firm situated in the heart of Delhi led by experienced, dynamic, young and enthusiastic Chartered Accountants and other professionals offering a broad spectrum of professional services to our Residents and Non Resident Indian (NRI) clients. For about 2 decades we are providing wide array of financial and advisory services to our Residents and Non Resident Clients including Lower rate of TDS, Repatriation/Remittances of money outside India, Form 15CA-15CB, advising clients in sale-purchase of properties and related consultancy services. We emphasize on quality of our professional services. We provide customized services ranging from advisory on all tax matters to handling of Tax litigation, Management consultancy and much more.

Latest Blogs

A Guide to ITR Forms for A.Y. 2025–26

A complete guide to ITR Forms for A.Y. 2025–26, including eligibility for ITR-1 (Sahaj), ITR-2, ITR-3, and ITR-4 (Sugam). Understand who can file which ITR, recent changes, capital gains reporting, presumptive income rules, and compliance updates for salaried individuals, NRIs, freelancers, and business owners.

25/05/2025

A Comprehensive Guide to LTCG and STCG for FY 2024-25

Understanding capital gains tax is crucial for investors and taxpayers. The Union Budget 2024 introduced significant changes to the taxation of capital gains, affecting both short-term and long-term investments. This guide will walk you through the key aspects of LTCG and STCG for FY 2024-25…

Understanding capital gains tax is crucial for investors and taxpayers. The Union Budget 2024 introduced significant changes to the taxation of capital gains, affecting both short-term and long-term investments. This guide will walk you through the key aspects of LTCG and STCG for FY 2024-25…

09/02/2025

A Comprehensive Guide to Budget 2024

Our F.M presented the budget speech in parliament on 23rd July 2024 and has announced significant relaxations in the income tax slabs under the new tax regime for FY 2024-25.

New Tax Regime

What deductions and exemptions are allowed under the new tax regime?…

Our F.M presented the budget speech in parliament on 23rd July 2024 and has announced significant relaxations in the income tax slabs under the new tax regime for FY 2024-25.

New Tax Regime

What deductions and exemptions are allowed under the new tax regime?…

03/02/2025

NRI Update: Crucial PAN-Aadhaar Linking Guidelines

The following categories of individuals are exempt from linking their PAN with Aadhaar by 30th June 2023:

– Individuals residing in the states of Jammu and Kashmir, Assam, and Meghalaya.

– Non-resident taxable persons as per the Income-tax Act, 1961.

– Super Senior Citizens (individuals aged more than 80 years).

– Persons who are not citizens of India.

22/01/2025

A Comprehensive Guide to Interim Budget 2024

The Hon’ble Finance Minister Shrimati Nirmala Sitharaman presented the budget speech in parliament on 1st Feb 2024. As this an interim budget, there are no major changes in taxation. While the major updations may hold off until after the 2024 general elections, the upcoming union budget presents an opportunity to address lingering concerns and set the stage for future economic growth.

10/02/2024

Consequences of Inoperative account – Dated 25/01/2024What Annual Information Statement (AIS) means for taxpayers?

The exempt category people need not link PAN-Aadhaar within 30th June 2023. The exempt category is as follows:

28/01/2024

Income Tax Slabs for FY 2023-24 (New & Old Regimes)

The old income tax scheme is also known as the existing tax regime. It is a tax structure that has been in existence for many years. Under this scheme, the tax rates are based on the income earned by an individual. The tax rates are as follows:

11/12/2023

Our Services

GOODS & SERVICES TAX (GST)

AUDIT & ASSURANCE

0

+

Satisfied Clients

0

+

Non-Resident Clients

Why Choose

Atul Mangal & Co

0

+

Highly professional team

Core Expertise in NRI Taxation & Real Estate Advisory

For nearly two decades, we have been offering a wide array of financial and

advisory services to Non-Resident Indian (NRI) clients, including Lower TDS

rates, Repatriation/remittances of money outside India, Form 15CA-15CB

compliance, Sale-purchase property advisory services.

With strategic partnerships with underwriters, we provide the best deals

tailored to client requirements, ensuring maximum return on investment.

One Roof Solutions

One stop solution for all your Taxation & consultancy needs. We render services ranging from advisory on all tax matters to handling of Tax litigation, Management Consultancy and much more

Customized Services

We provide services to our clients according to their requirements by using our expertise

Professional Quality

At “ATUL MANGAL & CO.” we have dedicated team of expert and experienced Chartered Accountants to ensure highest quality of professional services

Professional & Competent Personnel

We have a dedicated team of Expert Chartered Accountants who possess large amount of experience in NRI taxation and help our clients to make best decision.

Testimonials & Feedback

Testimonials & Feedback

“Sandeep Nath”

Atul is a magician not only with his logic and numbers but with the way he provides personal attention and remembers details, despite having an impressive portfolio of clients. I highly recommend him as a CA!

SELF RENEWAL & STRESS MANAGEMENT, (IIT,IIM)

“Nishant Tanwar”

I have been associated with Atul for over 10 years now. He’s extremely professional and helpful. I can’t imagine dealing with anyone else. I would highly recommend him for his services.

STAND-UP–COMEDIAN

“Kris Dewan”

I have known Mr Atul Mangal now for 8 years. He was introduced to me by a friend in India when my mother passed away. Since then, Mr Mangal has looked after my financial affairs in India with care and diligence.

He is quite knowledgeable about the Indian Tax System. I have no hesitation in recommending Mr Mangal’s services.

AUSTRALIA

“Ajay Kaul”

Have been working with Atul for last few years on my Indian tax returns filing and seeking financial advice. I have found Atul's domain expertise and experience very strong and he is always able to provide useful advice even in complex financial situations. He is highly responsive, communicates well and is proactive about meeting timelines and deadlines. I would recommend Atul as a trusted financial /tax partner to anyone needing sound advice on their simple or or complex financial matters.

Global Head of Growth Marketing, Ride-hailing and Food Delivery (DiDi)

“Rangarajan Raghavan”

Atul is taking care of all our income tax related matter for my whole family close to 2 decades. Very knowledgeable, very particle person, most importantly honest and keeps up the timeline without any reminders.

I am happy to see his site, this will help many more people to access his services.

I wish Atul all the success.

Rangarajan Raghavan

Managing Director India & Asia, HD Medical Services

“Sudhir Gandhi”

I have been seeking professional services from Atul Mangal Co for over a decade and as an NRI got tremendous satisfaction from their services.Mr Atul is well aware of the requirements and needs of Non Resident Indians in meeting their tax related obligations. I have truly appreciated his expert guidance from time to time and his professionalism over the last many years of association with him.

Sudhir Gandhi

DIRECTOR, SSKS INTERNATIONAL CANADA INC, CANADA

“Mohammed Ali Faisal”

Atul is a very motivated individual with positive attitude and vast knowledge who thinks out of the box, he has worked on multiple different assignments with me. He has the capability of bringing in innovative insights and has a very positive impact on the outcome. Since many years he is one shop window to all your commercial needs.

Mohammed Ali Faisal

Head Human Resources, LafargeHolcim, UAE

“Michael Bali”

Atul is extremely knowledgeable, trustworthy and professional. I highly recommend him for people who are looking to repatriate funds through a real estate sale back to the states. I will go back to him for my tax needs moving forward as well.

Michael Bali

USA

“Anant Dhotrekar”

A truly boutique yet professional service provided by Atul. I have been a client for 5 years and Atul has provided personalized service and no task is too small for them. Serving the needs of NRI customers like me, Atul and his team are truly a one stop shop for your Tax and Banking needs in India.

Anant Dhotrekar

USA

“Lokesh Verma”

I changed from my old CA to Mr. Atul’s firm on the advice of my father in law who is a Doctor and an old client of Mr. Atul and I couldn’t be happier. The best part is they are having a decade…

Lokesh Verma

TATTOO-ARTIST (Devilz Tattoos)

“Raj Vishwanathan”

I know Atul for a long time and have been using his tax and other services for a few years now. He is extremely competent and efficient and goes above and beyond his call of duty. His knowledge and wisdom extends beyond financial matters and he is able to offer intelligent advice and salient information for someone who lives abroad. I would recommend Atul’s services whole heartedly!

Raj Vishwanathan

USA

“Dheeraj Choudhary”

Have worked with Atul over 10+ years I can highly recommend him unreservedly. His attention to detail,

responsiveness and professionalism in addition to his expertise in managing NRI related matters is noteworthy. Atul is an excellent accountant and highly recommended.

DHEERAJ CHOUDHARY

Head of Indirect Procurement (BP)

Submit your feedback

Submit your Feedback

Atul Mangal & Co - The best CA firm in South Delhi

Our Services

- NRI SERVICES

- NRI Taxation Services

- NRI Property Sale In India

- Lower Rate of TDS

- 15CA-15CB FORMS FOR REMITTANCES

- NRI Compliances & Disclosures

- NRI Investment In India Consultancy

- NRI Returning To India Consultancy

- Estate Planning For NRI

- Double Taxation Avoidance Agreement Consultancy

- Types Of Bank Accounts An NRI Can Open

- Frequently Asked Questions

EXTERNAL LINKS

ABOUT US

- 011-41620109 / 011 49950109

+91 9212007566

011-41620109 / 011 49950109

Total Visits: 22848

Disclaimer:

The information provided under this website is solely available at your request for informational purposes only, should not be interpreted as soliciting or advisement. We are not liable for any consequence of any action taken by the user relying on material/information provided under this website. In cases where the user has any legal issues, he/she in all cases must seek independent legal advice

The information provided under this website is solely available at your request for informational purposes only, should not be interpreted as soliciting or advisement. We are not liable for any consequence of any action taken by the user relying on material/information provided under this website. In cases where the user has any legal issues, he/she in all cases must seek independent legal advice